Debt Relief Law Center, 3670 Maguire Boulevard, Suite 310, Orlando, FL 32803

Email Us: njtlaw@gmail.com

With the rise of delinquent debt and the outsourcing of that debt to shady collection agencies, having an attorney to protect your interests has become vital. Every day residents of Florida with credit card debt are harassed by a number of collection agencies that commonly use unethical and sometimes illegal means to attempt to collect debt.

Credit card holders are often subjected to repeated phone calls at home and at work, threats of legal action, threats of jail time, threats of wage garnishment and worse. All of those activities are illegal and contrary to the rights afforded you under federal and state laws, including the Fair Debt Collection Practices Act (FDCPA).

Many Credit Card Debt Collection Agencies often resell the debt to another debt collection agency or independent contractor who works out of his or her house.

When the consumer with the credit card debt is contacted by a debt collector, they are often informed the conversation is recorded, they want to tell you what their stance is, provide you payment options, and demand that you accept one of these payment plans paying by credit card or a debit card. It is important to realize that any so-called debt collection agency that refuses to give you the information you need is not a respectable corporation and should not be given any payment before consulting an attorney.

A few credit card issuers do not sell their credit cards debts but instead bring those lawsuits in their own names. Some of these credit card companies are: Capital One, Discover and American Express.

In addition to the credit card issuers, most credit card lawsuits are filed by debt buyers. A few of the most notorious debt buyers are: CACH, LLC, Midland Funding, Cavalry SPV I, Galaxy International, JHPDE Finance, Portfolio Recovery Associates, and LVNV Funding.

We first determine what defenses that you may have to the credit card lawsuit.

If we cannot determine that you have valid defenses to the lawsuit, we work out a payment plan that you can afford that hopefully includes debt reduction and monthly payments.

We Fight The Debt Collector

Every day those with credit card debt are harassed by a number of collection agencies that commonly use unethical and sometimes illegal means to attempt to collect debt.

Being harassed by creditors or debt collectors is illegal. There are both State and Federal Debt Collection Laws that exist to protect the consumer from harassment and other illegal activities by collection agencies, their subsidiaries, and third parties..

We will investigate your garnishment and make sure that the error is corrected. We will dispute the item, insisting that the information furnisher produces evidence substantiating the error or removes the item.

Wrongful Repossession. is a mechanism of the Federal Government to allow debtors (people who owe money) to restart their lives when they have gotten into a financial dilemma where there is no reasonable way to repay the debts they owe.

Orlando Consumer Rights Lawyer – watch these informative videos about consumer rights in the financial services industry.

We answer some of the most common Debt Collector Harassment Question that we hear on a daily basis.

Si usted es una de las millones de personas acosadas por un cobrador de deudas desaprensivo, la ley está de su parte. El Acta de Prácticas Justas Para el Cobro de Deudas, regula las prácticas de los cobradores de deudas y les impone sanciones que rompen las reglas.

What follows is a partial list of debt collectors who have sued or contacted consumers in the Central Florida area:

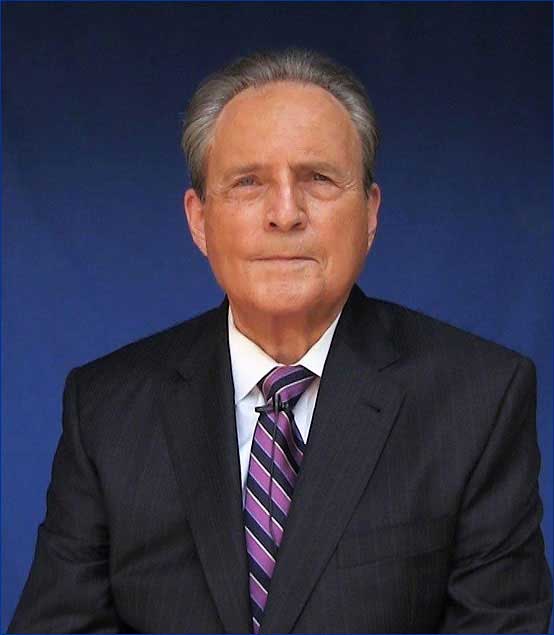

Orlando Debt Collection Defense Lawyer, N. James Turner proudly serves the Debt Collection Defense and Consumer Rights legal needs for residents of Orlando, Kissimmee, Orange County, Osceola County, Seminole County, and throughout Central Florida.

DEBT RELIEF LAW CENTER CASE EVALUATION QUICK FORM

Orlando Consumer Rights Lawyer – providing aggressive and affordable professional services to consumers who have been victims of debt collector harassment by debt collectors and Credit Repair, to residents in Orlando, Kissimmee, and throughout the Central Florida Area.

3670 Maguire Boulevard Suite 310, Orlando, FL 32803

Mon-Fri 9am-5pm

DISCLAIMER: The hiring of a lawyer is an important decision that should not be based solely upon advertisements. Before you decide, ask the lawyer to send you free written information about their qualifications and experience. This website has been prepared for informational purposes only and not as legal advice. Neither the transmission, nor your receipt of information from this website creates an attorney-client relationship, which can only be formed in writing between you and the attorney you choose to represent you.

Copyright 2021 Consumer Rights. All rights reserved.